🧠 Weekly Reflections #7: The Tale of 3 Graphs.

Hey Everyone –

Welcome to the 7th edition of the weekly reflections newsletter! I just found out recently that there is such a thing as national journaling day, but it's actually national notebook day (close enough). It's on May 18 this year for those interested.

That being said, let’s get into today's newsletter! 🫡

💎 Reflections from the Journal:

- Here are three graphs that tell a pretty interesting financial story:

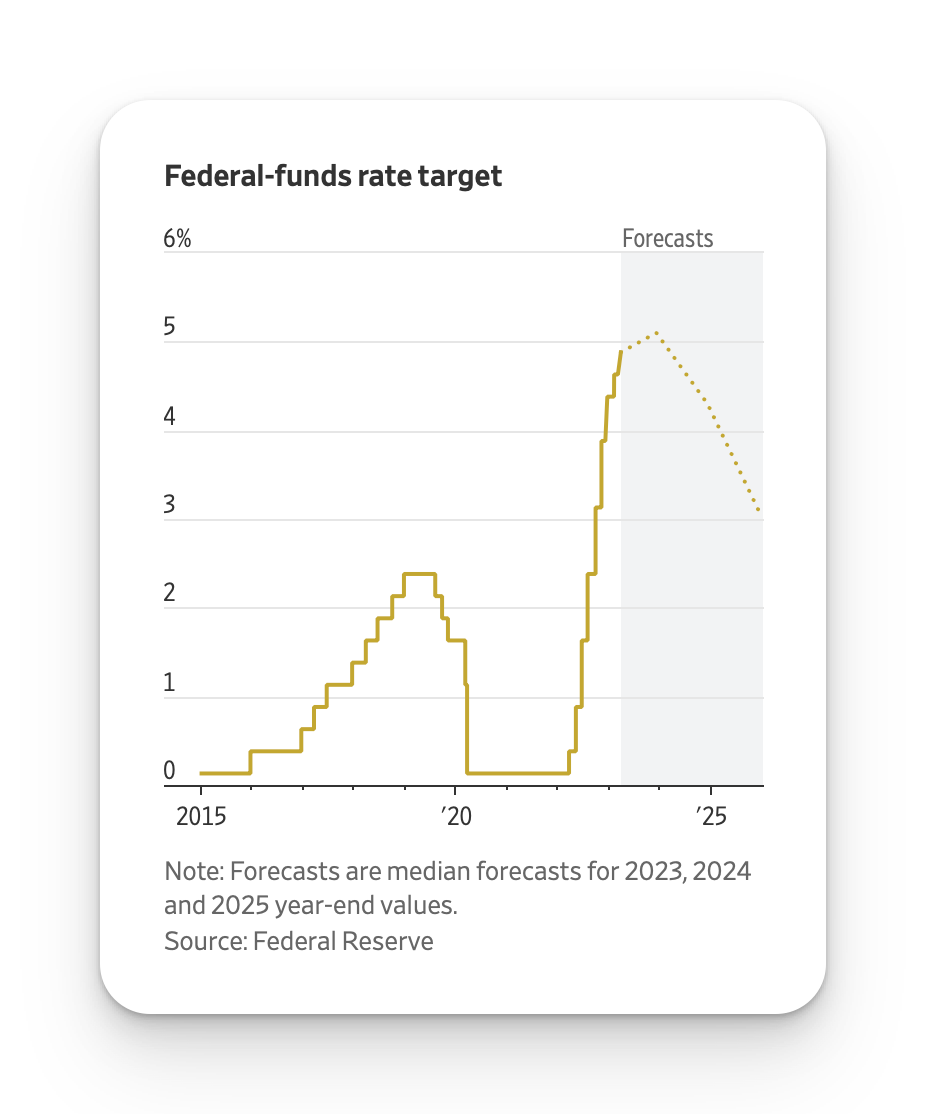

The Fed is locked-in 🔒

↳ As it turns out, the Fed is not the best therapist. With rising panic and fear in the markets, they still decided to push forward with raising the federal funds rate (the range that sets the interest rate) by .25%. It faced two hard decisions: Continue to fight inflation by raising rates or take care of the financial system by slowing rate hikes. By going with the former, they show that they are staying true to their priorities, but with increasing pressure from regulators to calm financial markets, we could see them stop raising rates sooner than expected.

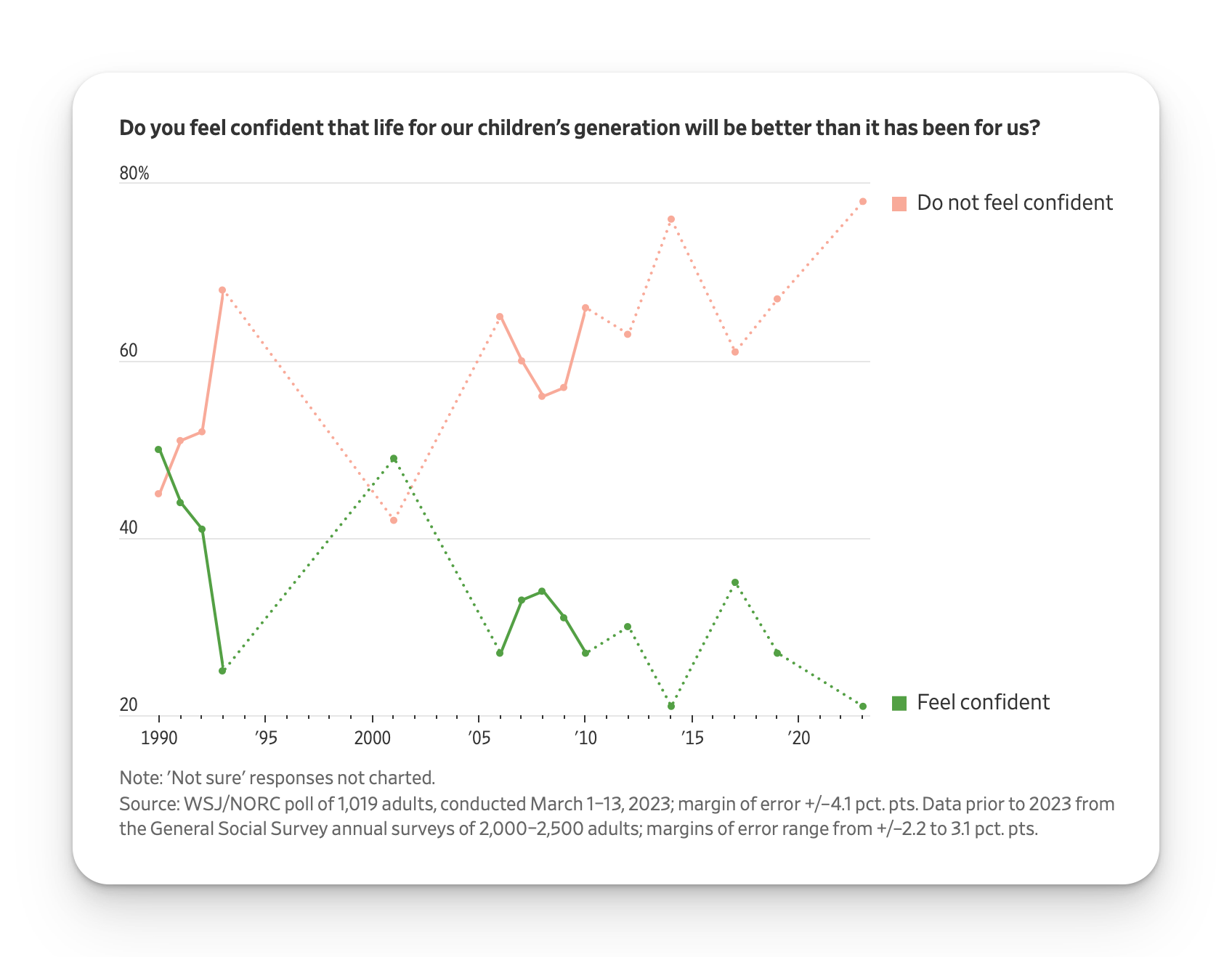

The parents are losing confidence 📉

↳ In the backdrop of bank collapses, rising rates, and high-inflation, the parents have about lost their confidence for future generations ability to handle all of this economic madness quicker than the Fed has been raising rates.

↳ Financial Literacy is becoming more important than ever, and for those wanting to take control of their 💸, I would recommend checking out YNAB (You Need A Budget) to get the ball rolling. If you're a college student, you can grab a whole year for free up until when you graduate too!

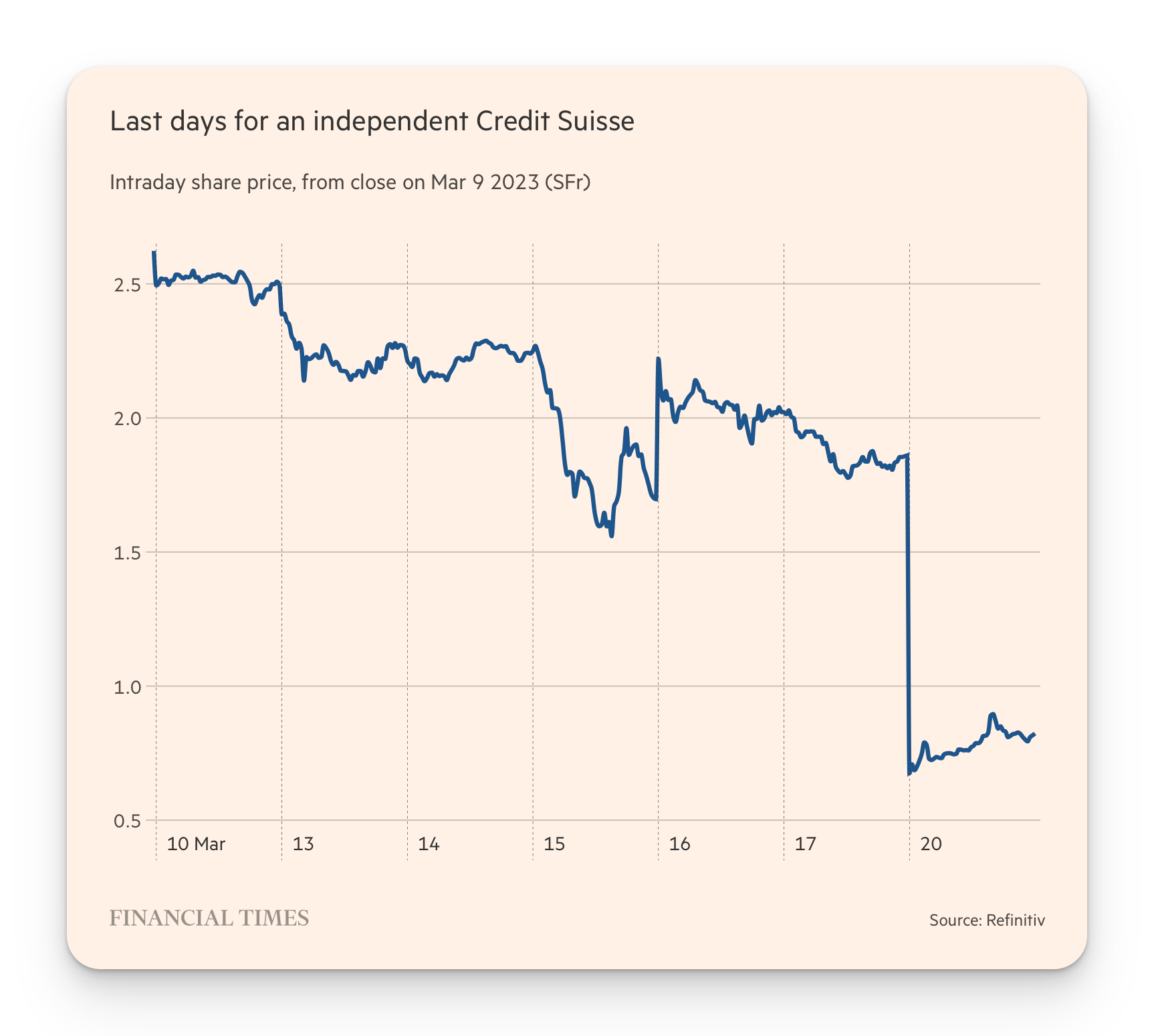

UBS was made an offer they couldn't refuse 🤝

The final terms were still so favourable to UBS they were “an offer we couldn’t refuse”, a person on the negotiating team told the FT. An adviser to Credit Suisse described them as “unacceptable and outrageous” and a “total disregard of corporate governance and shareholder rights”.

↳ Someone might have to send an copy of Never Split the Difference to Credit Suisse. As more details came out on the historic deal that ended the bank's 167 year run last week, it turns out that UBS got a deal of a lifetime as the Swiss 'trinity' (UBS chair Colm Kelleher, Swiss finance minister Karin Keller-Sutter, and Swiss president Alain Berset) orchastrated a deal that left Credit Suisse wanting more.

💭 More reflections from the journal

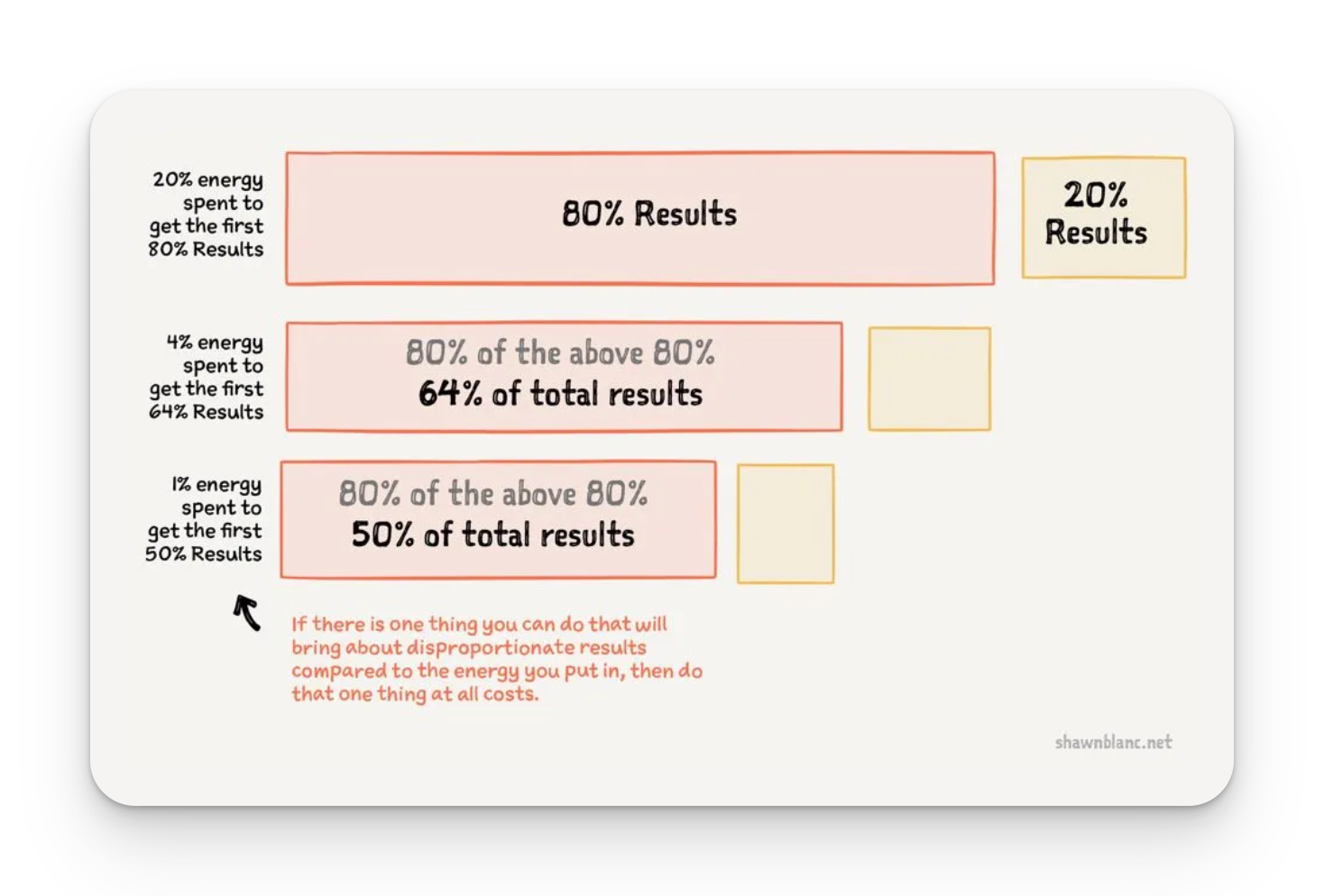

- I recently have been learning more about the 80/20 rule and how it applies into the way we approach framing our main priorities in the day and came across this interesting graphic:

↳ When coming up with your main priorities for the day, consider asking "What's the one thing I can that will require the least amount of energy but yield the most results when starting this priority?"

↳ Tagging that along to your priorities can offer some guidance so you can hit the groung running when starting your most important work for the day 🏃♂️ 💨.

🎙️ Favorite podcast moment of the week

- "The highest form of art is not appreciations from others’, it’s the lasting of your soul" (1:16:00)

❤️ Quote of the week

- "Listening is the art of understanding the meaning behind the words." - Simon Sinek

That's all I got for today. Love you guys, and see you next week!

Join my Newsletter, Weekly Reflections👇.

Each week, you will receive a weekly post with valuable insights, lessons, and resources I have picked up in my college journey on topics such as leadership, communication, and finances straight to your inbox, straight from the journal. Curated to interest you in at least one way. I promise. Sounds good? Subscribe below (and you can unsubscribe at any time, no hard feelings about it! 🫶).

Sign me up!

Member discussion